A cryptic three-word tweet from Donald Trump “THIS IS A GREAT TIME TO BUY!!!” sent shockwaves through global markets on April 9, 2025. But the real jolt came hours later, when he claimed his “friend Charles Schwab made $2.5 billion today.” What followed wasn’t just market chaos — it was a masterclass in political power play, financial windfalls, and questions of integrity that refuse to go away.

When Tweets Move Markets “A Timeline of Chaos”

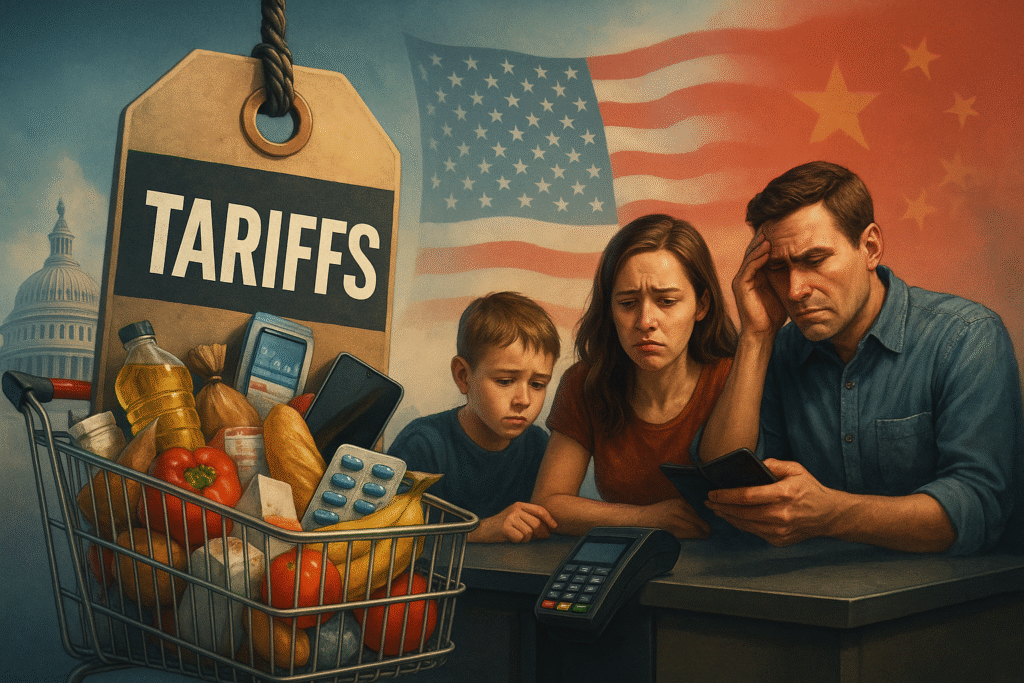

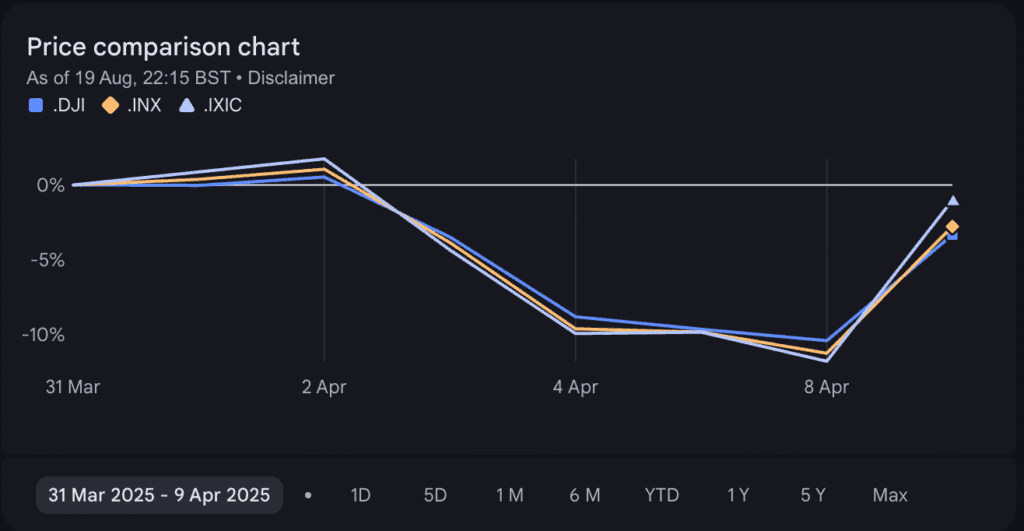

It all began with “Liberation Day,” April 2, 2025, when Trump declared a national emergency over America’s trade deficit and slapped a sweeping 10% tariff on nearly every U.S. import. He wasn’t done. By April 5, things escalated with steeper tariffs targeting 57 countries. The full brunt of these policies hit on April 9, the same day markets began collapsing across the board.

Hours into the financial turmoil, Trump took to Truth Social at 9:37 a.m. ET with his now-infamous tweet:

“THIS IS A GREAT TIME TO BUY!!! DJT”

By 1:18 p.m., he’d announced a 90-day suspension on those very tariffs, except for China, which saw its tariff jacked up to 145%. Within minutes, markets rebounded. The S&P 500 skyrocketed by 9.5%, and Trump’s own company stock, trading as DJT, nearly doubled. His personal net worth? Reportedly grew by $415 million in a single day.

But the real shock came when Trump, almost gleefully, declared:

“My friend Charles Schwab made $2.5 billion today.”

Was it an offhand remark? Or a loaded statement revealing something deeper?

Charles Schwab’s Windfall: Just Luck or Insider Advantage?

Charles Schwab, the billionaire founder of the financial behemoth bearing his name, holds around 18% of SCHW stock. On April 9, 2025, when shares of Charles Schwab Corporation jumped 9%, he personally gained over $1 billion. So where did the $2.5 billion come from? Possibly a mix of personal holdings, company-wide profits, and trading surges thanks to market volatility his firm thrives on.

This wasn’t just a coincidence. Trump’s sudden policy reversal sent stocks soaring including Schwab’s. And with Schwab’s company benefitting from massive trade volumes triggered by uncertainty, his profits weren’t just about luck. They were about timing and access.

The Web of Influence: Political Donations, Dark Money, and Trump

It’s not just about friendship. It’s about funding.

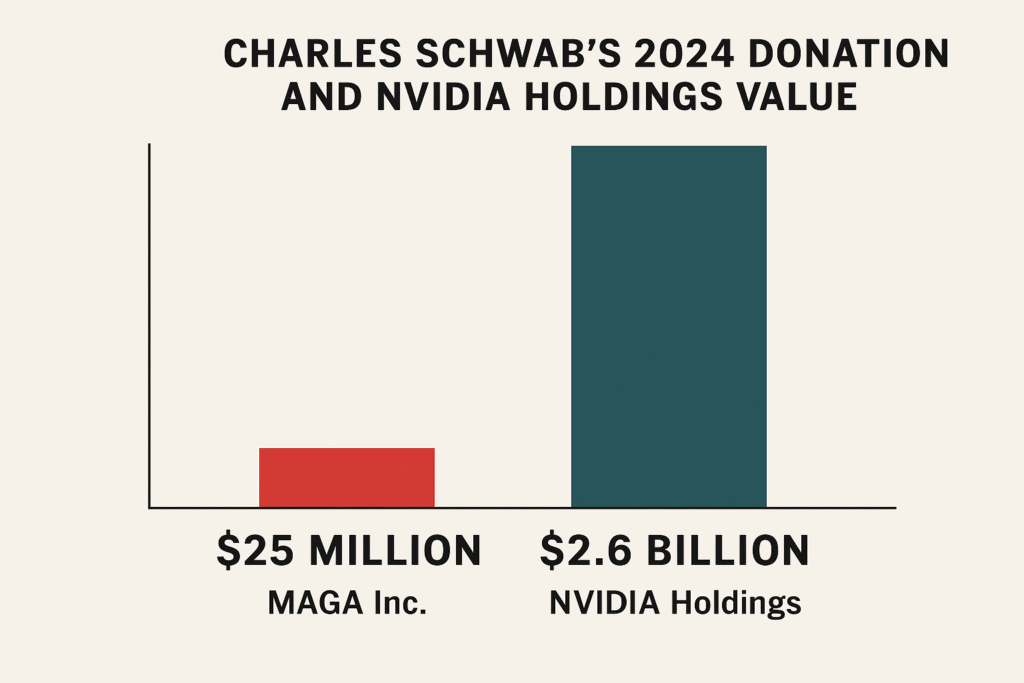

- In Q1 2024, Charles Schwab personally donated $1 million to Trump’s Super PAC “MAGA Inc.”

- Schwab’s firm also contributed over $54 million to conservative nonprofits tied to Project 2025, aimed at installing a future conservative regime.

- Since 2020, Schwab, Fidelity, and Vanguard have collectively funneled at least $171 million to such causes often through hard-to-trace channels.

This money trail suggests more than ideological support. It points to a political-financial pipeline, where policy moves and market benefits flow hand in hand.

NVIDIA, Intel & the Winners of the Tariff Shuffle

Charles Schwab Corporation wasn’t the only beneficiary.

- Schwab’s firm held $2.1 billion in NVIDIA stock as of late 2024. After Trump’s announcement, NVIDIA secured a revenue-sharing deal in exchange for relaxed export restrictions.

- Intel’s stock rose after rumors swirled that the Trump administration might buy a stake in the company using CHIPS Act funds.

- AMD and others who promised to build U.S. facilities conveniently dodged a proposed 100% import tariff on computer chips.

Critics labeled this strategy “crony capitalism”, where loyalty and money dictate policy, not national interest.

Market Mayhem as a Money Machine

While the broader economy trembled with projections warning of a 6% GDP hit and $22,000 lifetime loss for middle-income families, financial giants exploited the volatility.

Trading volumes exploded. Commissions soared. And firms like Schwab, with algorithmic agility and deep resources, thrived in the chaos. But was that chaos manufactured?

Insider Trading or Presidential Privilege?

Legal experts and lawmakers are split.

- Sen. Chris Murphy called it “an insider trading scandal in the making.”

- Sens. Ruben Gallego and Adam Schiff urged investigations into whether Trump or his circle used non-public information for personal gain.

- Sen. Bernie Sanders pointed to the obvious: market movements this predictable shouldn’t exist without foreknowledge.

Yet proving wrongdoing is a legal tightrope. Trump’s tweet though strategic was public. Insider trading laws demand the use of non-public information derived from a position of trust. Proving intent or manipulation when the information is technically available can be near impossible.

Still, the optics are damning.

A System Serving Profit, Not People?

Whether or not laws were broken, one thing is clear: the U.S. economic system is vulnerable not just to market shocks, but to presidential whims broadcast over social media. The tariff flip-flops, sudden policy U-turns, and opaque justifications create fertile ground for manipulation.

Trump’s actions and his boasts don’t just blur the lines between public duty and private gain. They bulldoze them.

Tweet First, Profit Later

Trump’s April 9 reversal didn’t just rescue markets. It minted fortunes for himself, for Charles Schwab, and for politically aligned corporations. The “$2.5 billion” wasn’t just a number. It was a symbol. Of access. Of influence. And of a presidency where economic policy often serves those closest to the power center.

This saga is more than a scandal. It’s a warning.

When tweets move trillions, and billionaires bankroll policy, democracy doesn’t just get tested it risks being sold off, one tariff at a time.

Explore More

Trump Transition Process and Ethics Battles: Power, Profits, and Accountability

The corridors of power are rarely transparent. They are shaped by promises made in public,…

The Shocking Truth Behind Charlie Kirk and Turning Point USA’s $250 Million Conservative Empire

The Charlie Kirk assassination on September 10, 2025, during a campus event at Utah Valley…

Charles Schwab and the $171 Million Secret Behind Wall Street’s ESG Facade

How Charles Schwab and other financial giants bankroll climate denial while selling sustainability to investors?…

Do Foreigners Pay for Tariffs? The Truth About Who Really Bears the Cost

When President Donald Trump unveiled his “America First” trade policy, tariffs were marketed as the…

Did Trump’s Tweet Make Charles Schwab $2.5 Billion Richer?

A cryptic three-word tweet from Donald Trump “THIS IS A GREAT TIME TO BUY!!!” sent…

The Files They Buried: How the Jeffrey Epstein Case Exposes a Broken Justice System

What if the truth was never lost, just buried? Years after Jeffrey Epstein’s shocking death,…