How Charles Schwab and other financial giants bankroll climate denial while selling sustainability to investors?

The Green Promise vs. the Dark Reality

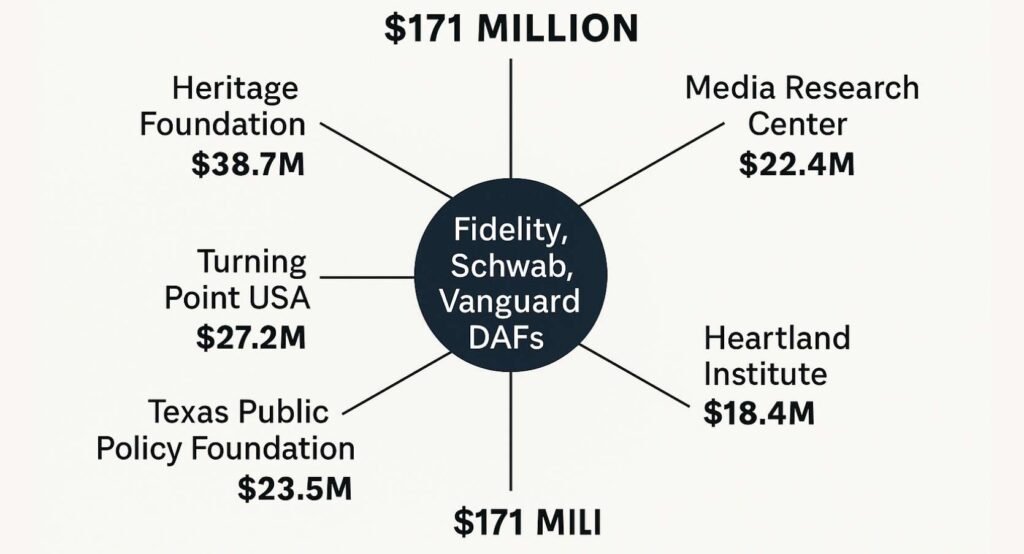

Behind the glossy ESG reports and polished sustainability campaigns lies a darker truth. Financial giants like Charles Schwab, Fidelity, and Vanguard brand themselves as leaders of “responsible investing.” They promote green portfolios, champion ESG initiatives, and market themselves as guardians of a sustainable future. However, the numbers tell a different story. Since 2020, these firms have funneled an astonishing $171 million into organizations linked to Project 2025, a political blueprint that dismisses the climate crisis and pushes hardline agendas. The contradiction is staggering: while Charles Schwab encourages investors to embrace sustainable finance, it quietly bankrolls groups working to dismantle climate protections.

How Donor-Advised Funds(DAF’s) Hide the Money Trail

The mechanism enabling this financial double life is deceptively simple: Donor-Advised Funds (DAF’s).

DAFs let wealthy clients deposit millions into accounts that generate immediate tax breaks while masking donor identities. Once funds enter, they legally “belong” to the financial institution, whether Fidelity, Vanguard, or Charles Schwab. The firm then disburses grants to charities and advocacy groups on the donor’s behalf, creating a cloak of anonymity.

Since 2020, these Wall Street DAFs have distributed $63 billion in grants, dwarfing even DonorsTrust—the conservative “dark-money ATM.” With over $50 billion flowing through DAFs annually, this is no niche loophole. It’s a financial juggernaut reshaping political influence while the public remains in the dark.

Critics call it a “legal fiction”: donors get tax benefits, firms like Charles Schwab keep their wealthiest clients happy, and society loses transparency in the process.

Who Gains From Charles Schwab’s Silent Funding Channels?

The money trail shows that Project 2025’s loudest champions of climate denial benefit from this shadowy system. Among the recipients:

- Heritage Foundation – $10.2M: Architect of Project 2025, infamous for blocking climate legislation.

- Turning Point USA – $11.7M: Platforms climate skeptics and cultivates fossil fuel ties.

- Texas Public Policy Foundation – $3.4M: Frames socialism—not climate change—as the true global threat.

- Media Research Center – $3M: Publishes content mocking climate science as “alarmism.”

- Heartland Institute – $1.3M: Releases reports claiming nature, not humans, drives climate change.

Each of these groups sits at the heart of Project 2025. Each has benefited from funds routed through Wall Street’s donor-advised accounts, including those managed by Charles Schwab.

The Myth of Neutrality

When confronted, firms like Charles Schwab insist: “Donors decide, not us.” But the record contradicts that defense.

In 2019, both Schwab and Fidelity blocked donations to NRA-affiliated charities during an IRS investigation. That moment proves discretion exists. These firms can intervene when reputational risk demands it.

The decision not to block climate denial groups is therefore no accident. It’s a deliberate choice, one that raises the question: whose interests is Charles Schwab really protecting?

Why It Matters

The $171 million funneled into Project 2025 is not just a financial transaction, it’s a threat to accountability, transparency, and democracy itself.

DAF secrecy allows Charles Schwab and other Wall Street leaders to present a public image of ESG advocacy while privately undermining it. Regulators, watchdogs, and even the IRS struggle to follow the money, leaving ordinary investors powerless to see where their funds truly go.

Experts like Helen Flannery of the Institute for Policy Studies argue for urgent reforms: requiring disclosure of donors contributing more than $10,000 through DAFs. Without such transparency, ESG risks collapsing into nothing more than a marketing slogan.

The Call for Transparency

The evidence is clear: while Charles Schwab promotes ESG in its marketing, it simultaneously enables the very forces working to dismantle climate progress. This dual identity—green advocate by day, anonymous financier by night, corrodes both public trust and democratic accountability.

True sustainability requires more than polished reports. It requires transparency. And until firms like Charles Schwab are held accountable for the hidden flows of dark money, the ESG promise will remain a façade, masking financial practices that undermine the fight against climate change.

Explore More

Trump Transition Process and Ethics Battles: Power, Profits, and Accountability

The corridors of power are rarely transparent. They are shaped by promises made in public,…

The Shocking Truth Behind Charlie Kirk and Turning Point USA’s $250 Million Conservative Empire

The Charlie Kirk assassination on September 10, 2025, during a campus event at Utah Valley…

Charles Schwab and the $171 Million Secret Behind Wall Street’s ESG Facade

How Charles Schwab and other financial giants bankroll climate denial while selling sustainability to investors?…

Do Foreigners Pay for Tariffs? The Truth About Who Really Bears the Cost

When President Donald Trump unveiled his “America First” trade policy, tariffs were marketed as the…

Did Trump’s Tweet Make Charles Schwab $2.5 Billion Richer?

A cryptic three-word tweet from Donald Trump “THIS IS A GREAT TIME TO BUY!!!” sent…

The Files They Buried: How the Jeffrey Epstein Case Exposes a Broken Justice System

What if the truth was never lost, just buried? Years after Jeffrey Epstein’s shocking death,…